Pets provide comfort and companionship, but they can also be a big financial responsibility. Emergency veterinary surgery can run anywhere from $1,500 to $7,000, according to 2024 data from Yelp; pulling a tooth can cost $500 to $3,000. Pet insurance can ease some of the worry of pet ownership by helping cover the cost of veterinary care if your pet gets sick or is injured.

To see how pet owners feel about pet insurance, recently surveyed more than 1,200 consumers.

![]()

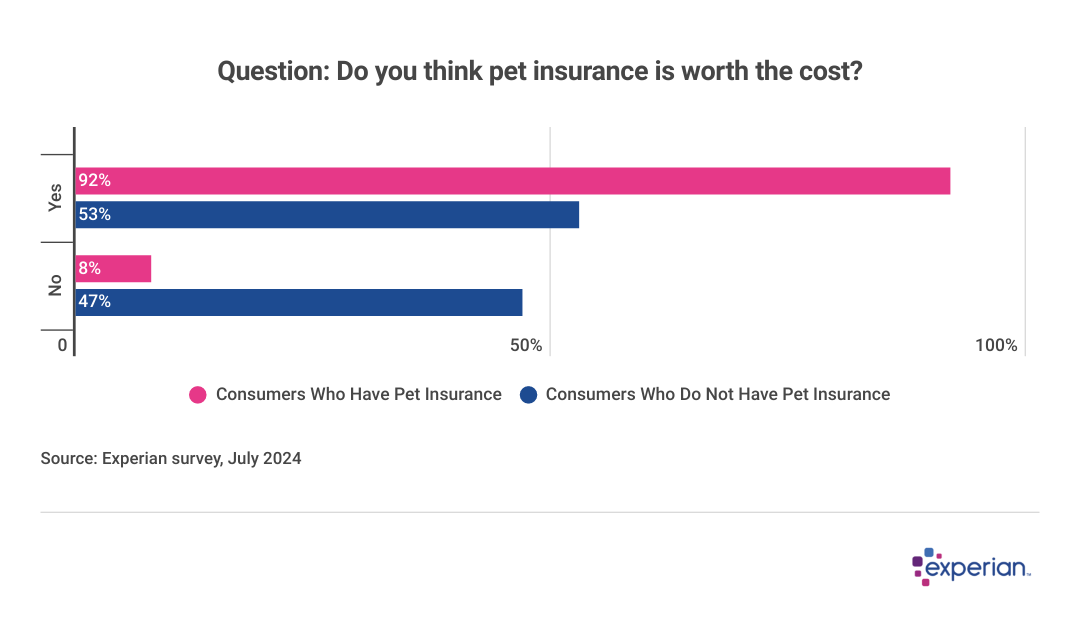

Nearly one in three pet owners say they have pet insurance; 92% of those who have it say it's worth it

The may be one reason just 29% of pet owners we surveyed said they have it. On average, premiums for pet accident and illness insurance cost $383.30 annually for cats and $675.61 annually for dogs, according to the North American Pet Health Insurance Association. Adding wellness coverage can nearly double that cost.

Among pet owners surveyed who have pet insurance, however, 92% say pet insurance is worth the expense. As one respondent said, "I have pet insurance so I don't have to decide between taking care of [my pets and] paying my mortgage."

Even among pet owners without pet insurance, 53% believe it's worth the cost. This suggests that price is the only thing keeping many pet owners from buying pet insurance. "Pet insurance would help us with unexpected pet costs [and] allow us to budget better," one respondent noted.

You can typically purchase three types of .

- Accident-only insurance covers injuries or accidents, such as insect bites, being hit by a car or eating something toxic. It doesn't cover pre-existing conditions or preventive care.

- Accident and illness insurance adds coverage for illnesses, such as cancer, diabetes, ear infections or urinary tract infections. It doesn't cover preventive care or pre-existing conditions.

- Wellness coverage can typically be added to the above policies to pay for routine vet visits and preventive care. For example, a wellness plan might cover dental cleanings, annual exams and vaccinations.

Exactly what's covered by each type of plan can vary widely, so it's important to investigate the details before you buy.

Vet visits more frequent among those with pet insurance

While pet insurance does cover a portion of your veterinary expenses, you're typically still responsible for paying a deductible plus a percentage of the vet bill. In addition, you usually have to pay the vet upfront, then file a claim with the insurance company and wait to be reimbursed.

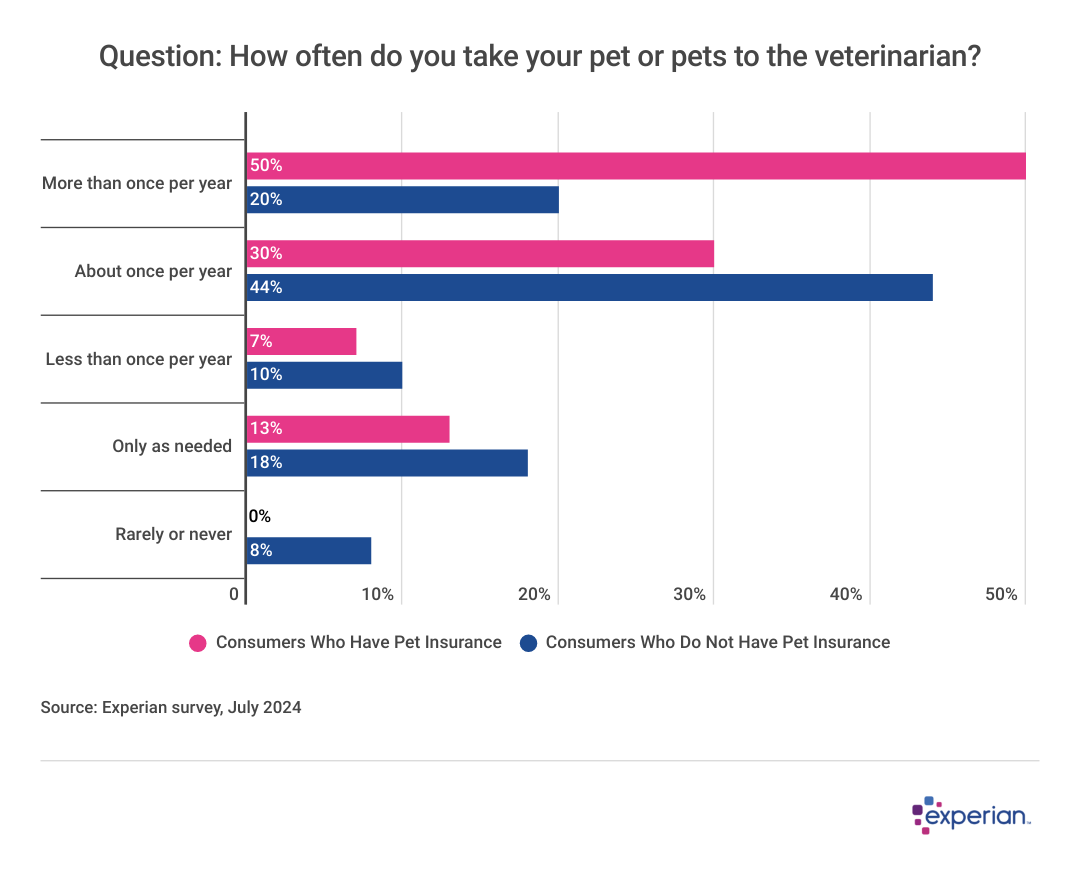

However, since most plans reimburse anywhere from 70% to 90% of the cost of covered care, pet insurance can make a significant dent in your vet bills. That may be one reason pet owners with pet insurance visit the vet more often than pet owners without it. Half of pet owners with pet insurance surveyed said they take their pet to the vet more than once a year, compared to just 20% of those without pet insurance.

This could indicate that pet owners with insurance are less likely to delay veterinary care due to cost. Frequent vet visits can catch potential health problems early while they're easier and less expensive to treat. Regularly visiting the vet for routine preventive care can also help keep your pet healthy, reducing the overall cost of veterinary care.

Those with pet insurance tend to spend more on their pets, feel more financially confident

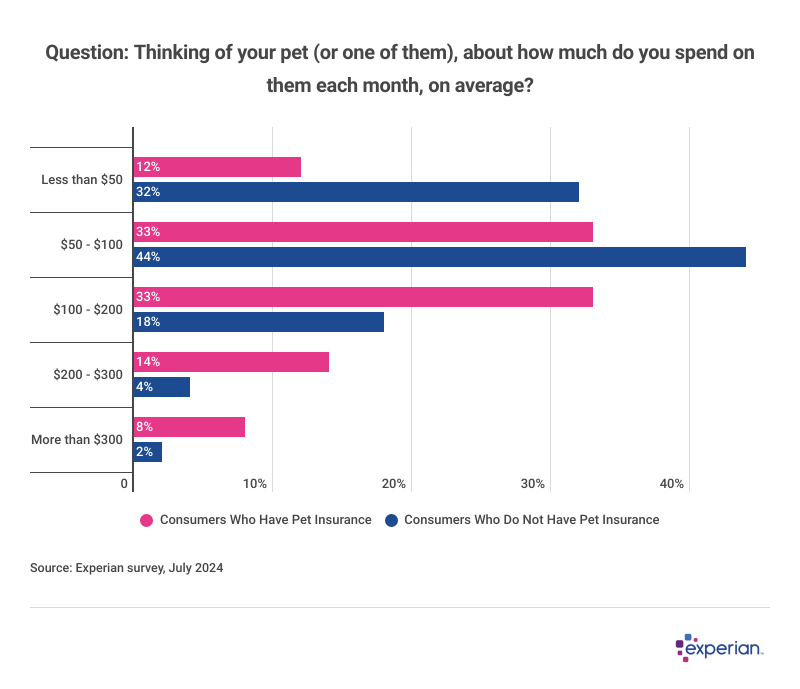

In general, survey respondents who have pet insurance said they spend more on their pets. On average, over half (55%) of those with pet insurance spend $100 or more on their furry friends each month, compared to 24% of those without pet insurance.

Of course, this spending may include pet insurance premiums, which would increase a pet owner's average pet expenses. However, people with pet insurance may also be spending more on veterinary care because they know the bills will be covered.

Survey responses indicated that people who are confident about their personal financial situation are also more likely to have pet insurance than those who aren't. Over one-third (41%) of pet owners we surveyed who feel extremely or very confident about their personal finances in the next 12 months have pet insurance. By comparison, just 22% of those who feel somewhat confident and 12% of those who feel only a little or not at all confident about their personal finances have pet insurance.

Feeling financially confident may spur pet owners to purchase pet insurance, knowing they can afford it. On the other hand, having pet insurance to help with unexpected vet bills might make pet owners more confident about their financial situation.

The bottom line

While pet insurance can be pricey, the majority of pet owners with the coverage say it's worth the cost. You can save money on pet insurance by choosing your coverage carefully, opting for a higher deductible and shopping around to compare prices. If you decide pet insurance isn't for you, building a solid , keeping credit utilization low and maintaining good credit can give you plenty of options for handling an unexpected vet bill.

Methodology

Experian surveyed 1,279 U.S. adult consumers to gather opinions on pet insurance. Survey conducted July 3, 2024. The sample was collected using a third-party company and was not from Experian's consumer credit database.

was produced by and reviewed and distributed by Stacker Media.