As interest rates have increased within the property tax deferment program, we have received both phone calls and emails asking us if we feel the program is still worth participating in. We feel it is still a great program for most retirees. If someone has excess money in the bank, and doesn’t like the idea of having any debt, then nothing wrong with paying the property taxes as normal.

Not every household has extra money. More people are becoming house-rich and cash flow poor. We hear many stories of people struggling with rising costs. With retirees not having the traditional employment income rolling in, watching what is spent becomes even more important. Our recommendation for our clients is normally to stay in their homes for as long as they can. We map out strategies to help clients stay in their homes.

Municipalities have mailed out their property tax notices in May. Like most things, property taxes are rising. In our past property tax deferment column, we noted the common ways to address your property tax liability. The first way is by paying your property taxes directly to your municipality. Some people pay this monthly, while others choose to pay annually. Individuals who have a mortgage can choose to pay their property taxes with their mortgage payment. With this option, your monthly payment to your lender is made up of a mortgage payment and an amount for your property taxes. Your lender will then pay your property taxes to your municipality for you.

Let’s look at another option, which is to not pay your property taxes and instead defer payment until the future sale of your home. This can be done through the Property Tax Deferment Program. In retirement, it’s not always how much money you make but how much money you spend, and the annual property tax bill is a big one. Inflation results in everything costing more and many retirees are feeling this from a cash flow standpoint. In our opinion, deferring your property taxes makes sense in most cases. Over the years, the majority of our retired clients have taken advantage of the Property Tax Deferment Program. If deferring property taxes help our clients stay in their homes longer, that is a success. There is no tax when our clients sell their principal residence in the future. Any program that enables our clients to keep their home longer term is good, in our opinion.

The Property Tax Deferment Program

The Property Tax Deferment Program is a low-interest loan program that assists qualifying homeowners in British Columbia by paying the annual property taxes on their homes. It was established in 1974 by the Province of British Columbia. The initial intent of this program was to assist seniors and the disabled who may not have readily accessible funds to pay their property taxes. The program ensures that the property tax burden each year would not result in an individual having to sell their home to cover this obligation.

Qualifications for the Property Tax Deferment Program

The general Property Tax Deferment qualifications require that you:

• Be the registered owner(s) of the home and that it is your principal residence where you live and conduct your daily activities

•Be 55 years of age or older OR a surviving spouse OR a person with disabilities as defined in the Employment and Assistance for Persons with Disabilities Act. Be a Canadian citizen or permanent resident under the Immigration and Refugee Protection Act (ÎÚÑ»´«Ã½)

• Have lived in British Columbia for at least one year immediately prior to applying

• Have paid all previous years’ property taxes, utility user fees, penalties, and interest

• Have a minimum equity of 25 per cent in your home based on its assessed value as determined by BC Assessment

• Pay property taxes to a municipality or the Surveyor of Taxes

• Have a current fire insurance policy on your home. For the purposes of calculating equity, your property value is based on the assessed value of both land and improvements. However, if you don’t have fire insurance on your property, your property value is based on the land value only. Manufactured homeowners who do not own land and do not hold a current fire insurance policy will not qualify for the tax deferment program.

• Be taxed as a residential (class 1) or residential and farm (class 1 and 9)

If you pay your property taxes to a First Nations band, you are not eligible to defer.

Only one registered owner must be 55 or older to apply for the regular program. Each registered owner or authorized representative must enter into a property tax deferment agreement and agree to the terms of the program.

At the time of application, the owner must turn 55 during that calendar year to qualify. You can defer your taxes if you own and live in your home and continue to qualify for the program. The deferred taxes must be fully repaid, with interest, at the time you sell the home or if you refinance – your financial institution may require you to repay the loan amount. If you are a surviving spouse, you are not required to repay the loan at the time of title transfer. A one-time administration fee of $60 is applied to new approved deferment agreements. You can renew your agreement each year with a $10 fee. The set-up fee and the renewal fees are added to the deferral amount. The administration fee is not subject to interest.

It is also important to note, the Property Tax Deferment Program also has a program for families with children, with different eligibility requirements and a different interest rate.

How to apply

Previously, applications for the Property Tax Deferment program would be submitted to your municipality. Now, they are submitted through British Columbia’s Ministry of Finance website using eTaxBC, which is a free and secure online service. This is the third year applications are to be submitted using eTaxBC for the Property Tax Deferment Program. An added bonus of using this online system is homeowners may now select auto-renewal to have their account automatically renew annually, so long as they still meet all eligibility requirements. With this online service, the need for paper forms is eliminated.

An application must be received and approved before the property tax due date, or you may have to pay late payment penalties on your property taxes that will be applied by either your municipality or the Surveyor of Taxes. A registered owner has until December 31 of the current year to apply for deferment.

For more information on property tax deferment programs for seniors and families with children, how to apply and program eligibility requirements, visit the .

You can also get information by email at [email protected] or call toll free 1-888-355-2700.

Interest Charges

If you choose to defer your property taxes, a key benefit to note is that the deferred amount is charged simple interest, this is better than compound interest which charges interest on interest. Another benefit is that the interest rate charged through the program is not greater than two per cent below the rate at which the province borrows money. The interest rate is set every six months by the Minister of Finance. The interest rates are set every April 1 and Oct. 1. As of the date of writing this column, the prime interest rate is currently at 6.95 per cent. The current interest rate on the Property Tax Deferment Program for the regular program is 4.45 per cent and is set for the period April 1, 2023, to Sept. 30, 2023. The rate may change every six months and will be reset again on Oct. 1, 2023.

Means Test

One of the most interesting components of the regular program is that there is no mention of a means test. Individuals of all income levels may apply, provided they meet the general qualifications. Although the program may have been designed for those struggling to pay expenses, others may also take advantage of the terms of deferment. With the interest charges as low as they are, individuals may choose to defer their property taxes for a variety of reasons. From an investment standpoint, this makes sense if an investor feels they could generate an after-tax return greater than the interest charges.

Families with Children Program

You may qualify for the Families with Children Program if you’re a parent, stepparent, or financially supporting a child. You must also meet 1) applicant, 2) property, and 3) equity qualifications to be eligible for the Families with Children Program:

1) Applicant qualifications - to qualify for this program, you must:

• Be a Canadian citizen or permanent resident of ÎÚÑ»´«Ã½

• Be a registered owner of the property

• Have lived in ÎÚÑ»´«Ã½ for at least one year prior to applying

• Pay property taxes for the residence to a municipality or the province, and

• Have paid all previous years’ property taxes, utility user fees, penalties, and interest

You are not eligible for this program if you pay property taxes to a First Nations band.

You must also be financially supporting either:

• A child who is under the age of 18 who lives with you full-time or part-time or who doesn’t live with you but you pay support for the child

• Your own child or stepchild of any age who is attending an educational institution (e.g. college or university)

• Your own child or stepchild of any age who is designated as a person with disabilities under the Employment and Assistance for Persons with Disabilities Act

• Your own child or stepchild of any age who, in the opinion of a physician, has a severe mental or physical impairment that: Is likely to continue for at least two years, directly and significantly restricts their ability to perform daily living activities, either continuously or periodically for extended periods, and as a result of those restrictions, they require an assistive device, the significant help or supervision of another person, or the services of an assistance animal to help perform those activities

You may need to show proof that you’re financially supporting a child to qualify for this program.

2) Property qualifications

To qualify for this program, your eligible property must:

• Be your principal residence (where you live and conduct your daily activities)

• Be taxed as residential (class 1) or residential and farm (class 1 and 9)

3) Equity requirements

You must have and maintain a minimum equity of 15 per cent of the property’s assessed value. This means that all charges registered against your property plus the amount of taxes you want to defer can’t be more than 85 per cent of the BC Assessment value of your property in the year you apply.

If you have a secured debt on your property, such as a mortgage or a line of credit, contact your lender before you apply to ensure your approval into the tax deferment program doesn’t conflict with the terms of your loan. In some cases, financial firms will not sign off on the Property Tax Deferment forms as it essentially raises the risk for the financial firm, as they become second in line if a default were to occur. For cases like this, you are not eligible for the Property Tax Deferment program.

Under the Families with Children program, you’re charged simple interest at a rate not greater than the prime rate of the Province’s principal banker. The current interest rate on the Property Tax Deferment Program for the Families with Children program is 6.45 per cent and is set for the period April 1, 2023 to September 30, 2023. The rate may change every six months and will be reset again on October 1, 2023.

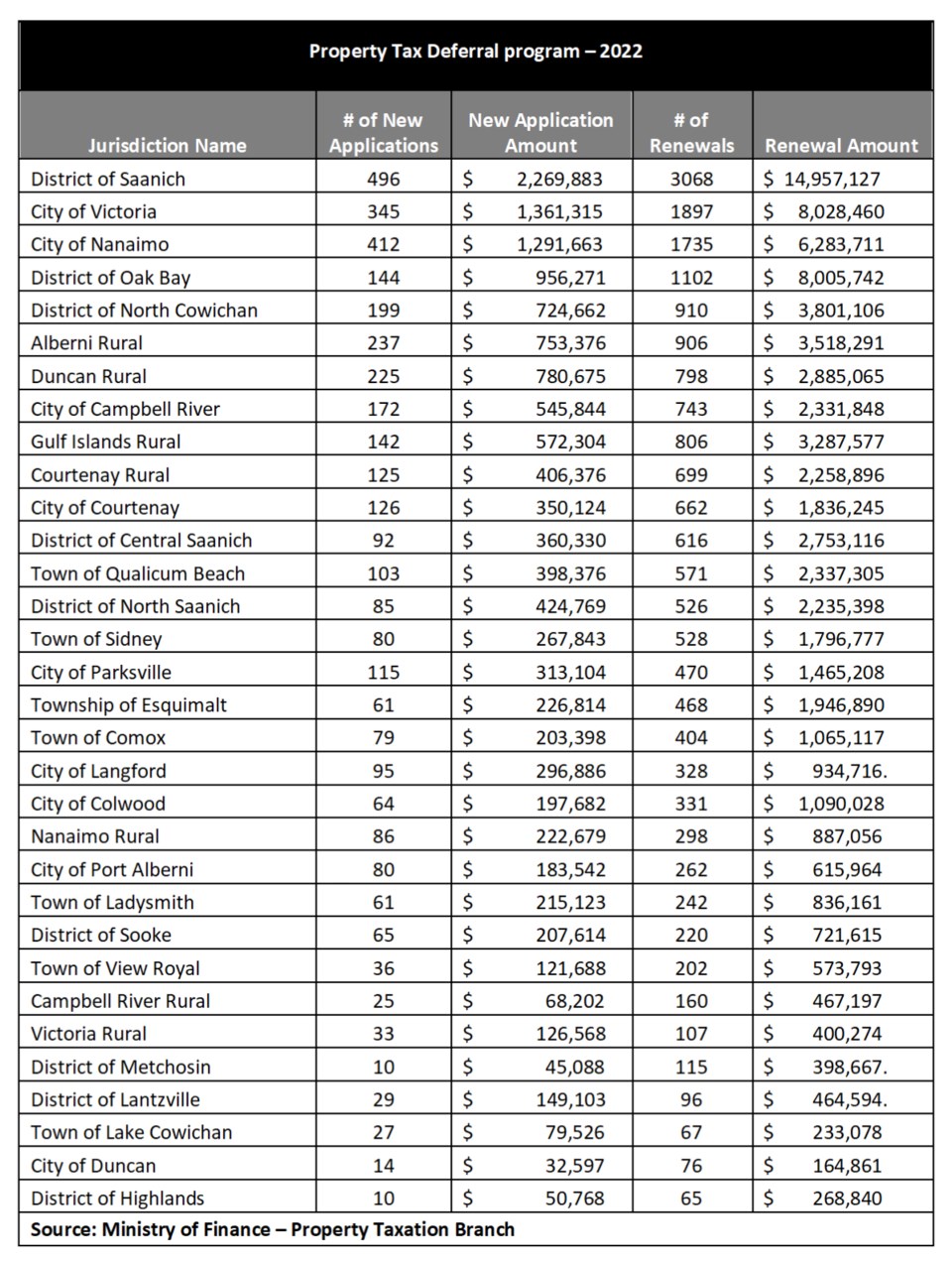

2022 Numbers for Vancouver Island

In our past articles on the Property Tax Deferment Program, we included the annual figures of cumulative amounts, which would include the new applications plus the renewal amounts (from those that applied to defer their property taxes in prior years). For purposes of this article, we have included both the new applications and the renewal amounts to show the current number of people applying and the cumulative number of residences who have already deferred their property taxes prior to 2022. To obtain the total deferred, you can simply add the new application amounts plus the renewal amounts.

Let’s use Saanich as an example for 2022. In 2022, 496 households were considered new applications within Saanich, meaning that they had not deferred their property taxes in prior years. The total amount deferred for 2022 for the new applications for Saanich was $2,269,883. In addition to the new applications, 3,068 renewed the property tax deferral application, and deferred an additional $14,957,127 for 2022. In total, Saanich property owners deferred $17,227,010 ($2,269,883 new applications + $14,957,127 renewal amounts). For 2022, 3,464 households (496 new applications + 3,068) are participating in the property tax deferral program.

The Greenard Group strategies to consider

If you qualify for the Property Tax Deferment Program and don’t have to pay your property taxes today, here are The Greenard Group’s top five favourite strategies to consider with the funds you would otherwise be using for your property taxes.

Strategy 1: The most basic strategy is to use the funds that you would normally use to pay property taxes to fund day-to-day expenses. This strategy is essentially the main reason the program was put into place.

Strategy 2: Another strategy for the use of the funds is to put these funds into a Tax Free Savings Account (TFSA) if you have not already maximized the account. Ensuring your TFSA is always topped up may give you another nest egg to prevent you from running into financial problems in the future.

Strategy 3: For individuals who are 55 plus and still earning significant income, redirecting the cash to top up your Registered Retirement Savings Plan (RRSP) contribution may be a prudent move.

Strategy 4: Another option instead of the TFSA and RRSP strategies is to either add to your non-registered investment account (or open a non-registered investment account if you do not yet have one) and begin building up a portfolio that will generate income for you (i.e. basket of dividend paying equities) throughout retirement.

Strategy 5: If your ultimate objective is to enhance your overall estate value, then proceeds could be used to fund a life insurance policy.

Prior to implementing any of the above strategies, you should contact your accountant and Portfolio Manager to see what course of action is appropriate for you.

Kevin Greenard CPA CA FMA CFP CIM is a Portfolio Manager and Senior Wealth Advisor with The Greenard Group at Scotia Wealth Management in Victoria. His column appears every week at timescolonist.com. Call 250.389.2138.