We are strong believers in diversifying investments geographically and with different currencies.

In the longer term, we recommend having a mixture of both U.S. dollar (USD) and Canadian dollar (CAD) denominated investments. At times we will recommend reducing or increasing the exposure to the USD.

Below we have mapped out one commonly used strategy The Greenard Group uses to reduce currency costs when converting between these two currencies.

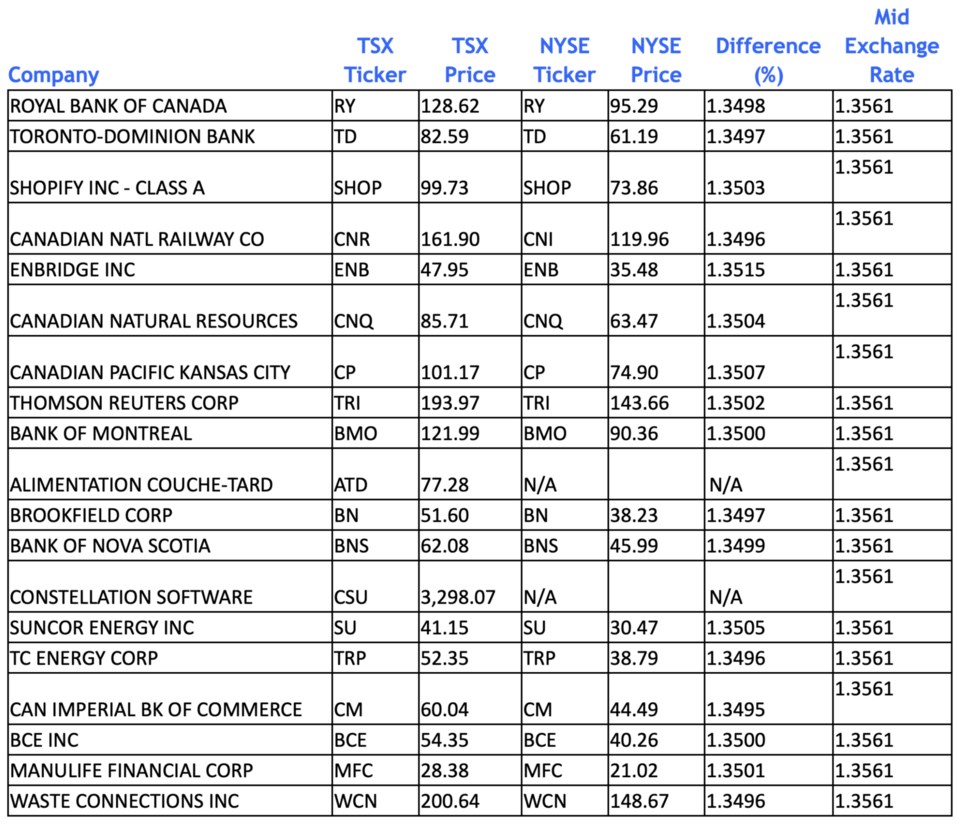

Canadian stocks within The Greenard Group Index

All of the Canadian stocks that are held within The Greenard Group Index model portfolios are among the largest on the Toronto Stock Exchange (TSX).

One of the criteria for the Canadian companies in our model portfolio is that a minimum of 80 per cent of the stocks must also be inter-listed on the New York Stock Exchange (NYSE). When stocks are inter-listed, it means that they are listed on both the TSX and NYSE.

One item to note is that although they are listed on different stock exchanges, they are not different stocks. When the Canadian dollar is weaker than the U.S. dollar, which is most of the time, the trading price on the TSX will be higher than on the NYSE — the difference is simply the exchange rate between the CAD and USD.

​ ​

​

Eighteen of the 20 largest stocks are listed on both the Canadian Toronto Stock Exchange (TSX) and the U.S. New York Stock Exchange (NYSE).

The stock symbol is typically the same — but not always. For example, Canadian National Railway’s stock symbol in ÎÚÑ»´«Ã½ is CNR.TO, and on the NYSE it is CNI.US.

Alimentation Couche-Tard and Constellation Software are not inter-listed; however, the other 18 companies are.

Canadian companies trading on the NYSE

It is possible to download a complete list of . This quarterly list (prepared on March 31, June 30, Sept. 30, and Dec. 31) is posted on the TSX website per subsection 6.6.1(4) of National Instrument 23-101.

As of Sept. 30, 2023, there were 215 Canadian companies also listed in the United States.

U.S. companies trading on the TSX and TSX Venture

On the flipside, we see many . What we find with the American companies is that it is not the largest companies that list in ÎÚÑ»´«Ã½.

There are five reasons U.S. companies may choose to list on the TSX (according to the TSX):

1. Access to capital — Going public can provide companies with financing opportunities to grow their business via expansion of operations, hiring or acquisitions.

2. Long-term growth — As a public company, shares can be used as a currency substitute to acquire target companies, instead of a direct cash offering. Using shares for an acquisition can be a tax-efficient and cost-effective vehicle to finance such a transaction.

3. Increase visibility and prestige — Going public enhances a company’s visibility. Greater public awareness gained through media coverage, publicly filed documents and coverage of the shares by sector investment analysts can provide companies with a higher profile and greater credibility.

4. Provide liquidity for shareholders — Becoming a public company establishes a market for a company’s shares, providing investors with an efficient and regulated vehicle in which to trade their shares.

5. Create employee incentive mechanisms — Employees can participate in the ownership of a company and benefit from being shareholders. Share ownership can have an immediate and tangible value to employees and can be used as a recruitment incentive.

Arbitrage opportunities

What is interesting when you look at the chart of ÎÚÑ»´«Ã½’s largest publicly traded companies is that the pricing of both stocks should be efficient or else arbitrage traders would take advantage of the discrepancy by shorting one side of the stock currency (i.e. CAD), and going long the other side of the stock currency (i.e. USD), and netting the two on settlement for a riskless trade.

If you divide the TSX price by the NYSE price, you will get the percentage difference. If the markets are efficient then this should be approximately equal to the mid exchange rate.

Spread information for illustrations

For purposes of the two illustrations below, we will assume that the bid exchange rate (price to sell) is 1.3240, mid exchange rate is 1.3561, and ask exchange rate (price to buy) is 1.3620. If you were wanting to purchase $10,000 USD, the rate would be 1.3620 and would require $13,620 CAD. If you were wanting to sell $10,000 USD, the rate would be 1.3240 and you would receive $13,240 CAD.

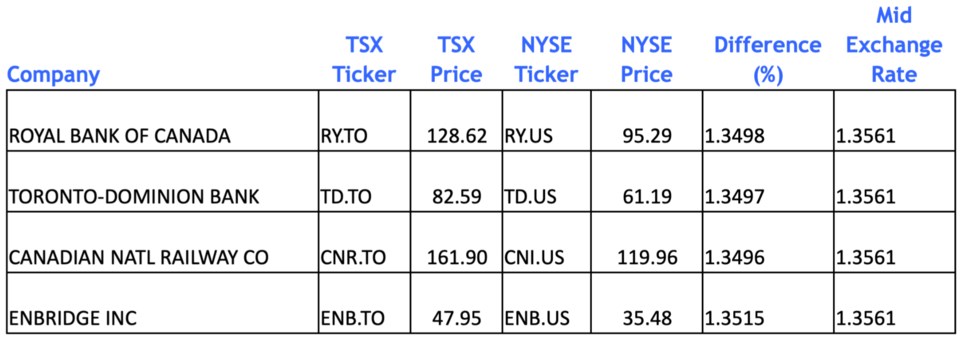

Illustration 1

A client has $100,000 in USD from recent rebalancing trades. The client would like to convert the USD back into CAD denominated equity holdings. We discussed with the client the option of doing inter-listed trades. Below is an example of some inter-listed trades, and the three steps.

​ ​

​

Step 1: Purchase Canadian companies on USD side (US = NYSE) that settle on the US side.

Buy 262 shares of RY.US at $95.29 per share = $24,965.98 USD

Buy 408 shares of TD.US at $61.19 per share = $24,965.52 USD

Buy 208 shares of CNI.US at $119.96 per share = $24,951.68 USD

Buy 704 shares of ENB.US at $35.48 per share = $24,977.92 USD

Cash Remaining $138.90 USD

Total Value = $100,000 USD

Step 2: Journal the Canadian companies from the USD side to the CAD side and convert the residual cash at 1.3240. After the journal, the CAD side (.TO = TSX) of the account would look as follows:

262 shares of RY.TO at $128.62 per share = $33,698.44 CAD

408 shares of TD.TO at $82.59 per share = $33,696.72 CAD

208 shares of CNR.TO at $161.90 per share = $33,675.20 CAD

704 shares of ENB.TO at $47.95 per share = $33,756.80 CAD

Cash Remaining $183.90 CAD

Total Value = $135,011.06 CAD

Step 3: (Only if CAD dollar needed) Sell the securities on the CAD side and convert the USD cash and the Total Value is $135,011.06 CAD.

If the $100,000 USD was simply converted to CAD the rate would be 1.3240, and result in $132,400 CAD ($100,000 USD x 1.3240). By utilizing the inter-listed stock strategy, it is possible to save $2,611.10 CAD on the conversion whether keeping the funds invested in CAD equities or liquidating to CAD cash.

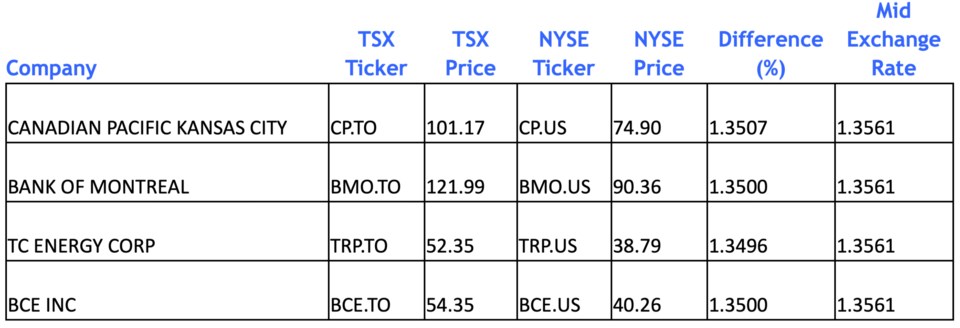

Illustration 2

A new client does not have any USD securities or USD. The client would like to convert $100,000 CAD into USD. We could execute some inter-listed trades, and journal these on settlement to the USD side of the investment account.

​ ​

​

Step 1: Purchase Canadian companies on CAD side (TO = TSX) that settle on the US side.

Buy 247 shares of CP.TO at $101.17 per share = $24,988.99 CAD

Buy 204 shares of BMO.TO at $121.99 per share = $24,885.96 CAD

Buy 477 shares of TRP.TO at $52.35 per share = $24,970.95 CAD

Buy 459 shares of BCE.TO at $54.35 per share = $24,946.65 CAD

Cash Remaining $207.45 CAD

Total Value = $100,000 CAD

Step 2: Journal the Canadian companies from the CAD side to the USD side and convert the residual cash at 1.3240. After the journal, the USD side (.US = NYSE) of the account would look as follows:

247 shares of CP.US at $74.90 per share = $18,500.30 USD

204 shares of BMO.US at $90.36 per share = $18,433.44 USD

477 shares of TRP.US at $38.79 per share = $18,502.83 USD

459 shares of BCE.US at $40.26 per share = $18,479.34 USD

Cash Remaining $156.68 USD

Total Value = $74,072.59 USD

Step 3: (Only if USD dollar needed) Sell the securities on the USD side and Total Value equals $74,072.59 USD

If the $100,000 CAD was simply converted to USD, the rate would be 1.3620, or $73,421.44 ($100,000/1.3620). By utilizing the inter-listed stock strategy, it is possible to save $651.15 CAD on the conversion whether keeping the funds in USD equities or liquidating to USD cash.

For clients ultimately wanting cash, the risk in executing the inter-listed stock strategy is that the underlying stocks used could fluctuate in value. The savings with this strategy is essentially the difference between the ask/bid exchange rates and mid exchange rate.

Typically, this spread is approximately two per cent. Provided the stocks do not fluctuate greater than two per cent in the wrong direction, this strategy is worth considering. Of course, the stocks used could also fluctuate in a positive direction making the strategy even better.

Kevin Greenard CPA CA FMA CFP CIM is a Senior Wealth Advisor and Portfolio Manager, Wealth Management with The Greenard Group at Scotia Wealth Management in Victoria. His column appears every week at timescolonist.com. Call 250-389-2138, email [email protected], or visit .