The financial world is full of terminology that is often a bit confusing. There are some great resources that we reference regularly to assist clients to obtain a clear understanding of how currencies impact the value of their investment portfolio. Our article, A Primer on Currencies and Investing, outlines the initial talking points.

Benchmarking is an important component to review when discussing investment performance. Most clients like to look at the bottom line — what is the change in the market value of your investments? A portfolio holding both Canadian and foreign investments need to factor in the changes in currencies, relative to the Canadian dollar. Monitoring currency changes monthly is easy to do when looking at your monthly statements.

Monthly currency changes

If someone had an investment portfolio worth $920,320 USD, according to the Bank of ÎÚÑ»´«Ã½ on Nov. 29, 2023, this would be worth $1,250,715 CAD. When monthly statements are issued to clients, the USD foreign exchange rate, located on the bottom left-hand side of the Scotia Wealth Management investment statements, provides the account holder with the conversion rate to determine the CAD dollar month-end equivalent value.

By the time clients receive the statements, the foreign exchange rate will have already changed. Below are some resources to find the exchange rate on any given day.

Bank of ÎÚÑ»´«Ã½ resource

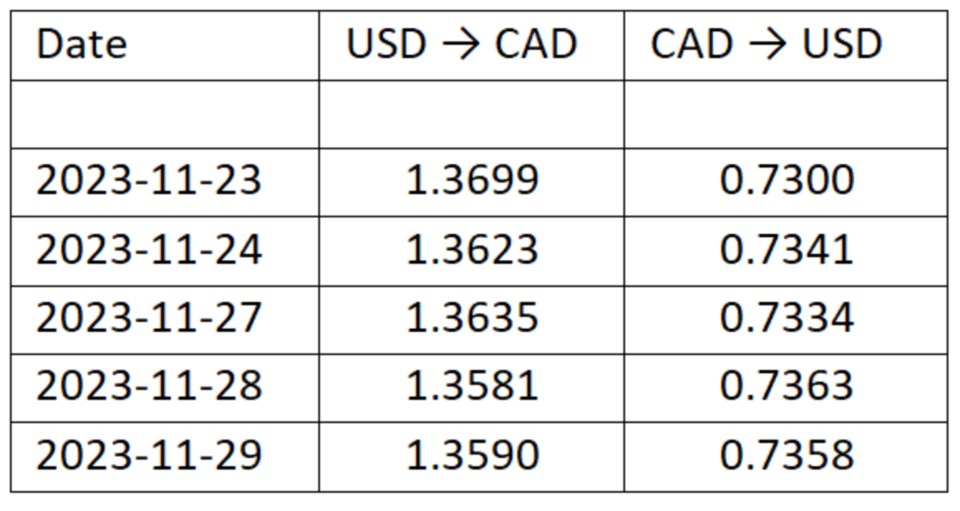

The best external website we recommend people visit is the Bank of ÎÚÑ»´«Ã½ to obtain the actual exchange rates, whether you are converting USD to CAD or whether you are converting CAD to USD. The website will give you the daily exchange rates for both directions, for the period you select.

The daily exchange rate noted on the Bank of ÎÚÑ»´«Ã½ will give you a ballpark of what a reasonable rate should be when calculating the value of your USD denominated investments and cash balances. The amount of USD dollars for which you can trade CAD dollars, or vice-versa, is not the daily exchange rate as posted on the .

It is easy to look up additional exchange rates on foreign currency websites (in addition to the Bank of ÎÚÑ»´«Ã½ website), or by phoning financial institutions to obtain a rate or visiting a bank or foreign currency business in person.

The exchange/conversion rates for transactions would include fees and would vary between institutions. To complicate matters, rates are subject to change throughout the day.

Other factors that may change the exchange/conversion rate is the total dollar amount you want to convert, the item you wish to convert whether it is physical cash, cheque, bank draft, or in electronic form.

When exchanging currencies at a bank or foreign currency businesses, the transaction receipt will show you the conversion rate which has the fee component built into the rate.

The spread

The fee component that is built into financial institution foreign exchange rates is often referred to as the spread. The “bid price” is the rate which the market is willing to pay for one unit of the currency you are wanting to sell. The “offer price” or the “ask price” is the rate which the market is willing to sell for one unit of the currency you are wanting to purchase.

The spread is simply the difference between the bid and the ask price. A wider spread often indicates a greater uncertainty in the currency or a less liquid market. In explaining currencies to clients, we refer to the Bank of ÎÚÑ»´«Ã½ daily exchange rate as the “mid-rate” and we will explain using the Nov. 29, 2023, daily exchange rate of 1.3590.

If a person walks into a financial institution and wishes to use CAD to purchase $7,000 USD for an upcoming holiday. The offer or ask price for USD may be 1.3940. The person would require $9,758 CAD to purchase $7,000 USD.

The difference between the financial institution rate and the daily exchange rate is essentially the spread, which in this case is (1.3940 -1.3590) = 0.0350/per dollar converted, or $245.00 CAD for a $7,000 USD transaction.

This person returns to the financial institution after he received news that his holiday has been cancelled and will not be needing the USD after all. He wishes to sell $7,000 USD and purchase CAD. The bid price for USD may be 1.3250. The person would receive $9,275 CAD.

The difference between the financial institution rate and the daily exchange rate is essentially the spread, which in this case is (1.3590-1.3250) = 0.0340/per dollar converted, or $238.00 for a $7,000 transaction.

The total foreign exchange costs for the above two transactions was $483.00 ($245.00 + $238.00).

Financial institutions run the risk of holding foreign currency so their clients may have access if requested. They also have staff that must be paid and overhead to pay. Every time we do a transaction, we look at both the bid and ask price in comparison to the daily exchange rate. Historically, in times of market turbulence and uncertainty the spread can widen.

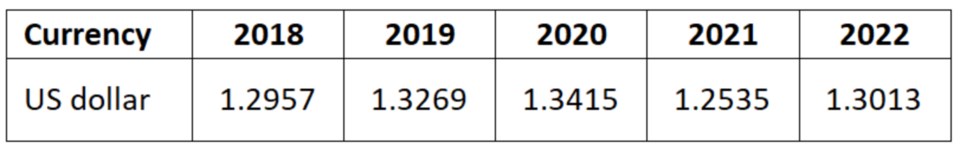

Annual exchange rates

The Bank of ÎÚÑ»´«Ã½ posts the annual exchange rates, for most major currencies .

Below is a table of the U.S. dollar exchange rate in relationship to the Canadian dollar over the five recent days.

All of our clients who invest in U.S. securities within a non-registered account will receive a T5 to report the foreign dividend income and any foreign tax credits. The dollar amounts of the foreign income is reported in USD as per box 15 of the T5 slip. The tax withheld is recorded in box 16 of the T5 slip along with the information slips which shows the dates of each dividend through the calendar year.

Investors have the option to convert each dividend payment to Canadian dollars at the exchange rate on the date the income was received. In nearly all cases, this is not done, as it would be too tedious and time consuming. ÎÚÑ»´«Ã½ Revenue Agency (CRA) permits Canadians to use the posted average rate as noted above.

Illustration

John Williams receives a 2022 T5 (USD) slip reporting foreign income (dividends on US equities). Box 27 shows the reporting currency as USD. Box 15 will show the foreign income of $10,320 (this is essentially the dividends received on his basket of US common shares). And Box 16 will show the foreign tax paid of $1,548.

The foreign tax paid is 15 per cent that the United States withheld on the foreign income at source. As ÎÚÑ»´«Ã½ and the United States have a tax treaty, Canadians avoid double taxation as they get credit for the foreign tax the Unites States withheld.

When John is entering this slip in Turbo Tax, he will have to manually convert the funds into Canadian dollars. John chooses to use the average exchange rate posted by the Bank of ÎÚÑ»´«Ã½. For 2022 the average exchange rate was 1.3013.

John will enter $13,429.42 ($10,320 x 1.3013) in Box 15 which is the Canadian equivalent value. John will enter $2,014.41 ($1,548 x 1.3013). John will leave box 27 showing USD.

In the description component of entering the slip we recommend adding USD slip. CRA performs a matching of slips submitted by financial institutions against slips you entered on your tax return. If you use an exchange rate other than the average rate you may have a higher likelihood of getting flagged with CRA’s matching and may have to send in support with your calculations if requested.

Actual exchange rate

The above illustration highlights how investors can use an average exchange rate when it comes to the income component on foreign investments. Investors are not able to use an average when it comes to the actual cost of an investment denominated in a foreign currency when calculating the book costs of an investment in Canadian dollars, the proceeds of an investment in Canadian dollars, and the ultimate realized gain or loss in Canadian dollars.

Below is an illustration showing how the actual rate must be used and not the average rate.

Illustration

William Johansen purchased 100 shares of Microsoft on June 3, 2022, at $270.02/per share when the USD exchange rate was at 1.2593. The book value for Canadian tax purposes is $34,003.62 calculated as follows: 100 x 270.02 x 1.2593 [the actual exchange rate on the date of purchase].

It is not possible for William to use the average exchange rate of 1.3013 that can be used for T5 foreign income, such as dividends for U.S. companies. The same applies for when William sells Microsoft.

William Johansen sold 100 shares of Microsoft on Nov. 21, 2023, at 373.07/per share when the USD exchange rate was 1.3697. The proceeds for Canadian tax purposes is $51,099.40 calculated as follows: 100 x 373.07 x 1.3697 [the actual exchange rate on the date of disposition].

William must use the CAD book value and the CAD proceeds to calculate the capital gain in CAD dollars. The capital gain on Microsoft is calculated as follows: Proceeds for Canadian tax purposes of $51,099.40 - Book value for Canadian tax purposes of $34,003.62 equals a $17,095.78 capital gain in CAD.

Kevin Greenard CPA CA FMA CFP CIM is a Senior Wealth Advisor and Portfolio Manager, Wealth Management with The Greenard Group at Scotia Wealth Management in Victoria. His column appears every week at timescolonist.com. Call 250-389-2138, email [email protected], or visit greenardgroup.com.