When we meet with prospective clients, we analyze their current investments from the standpoints of risk, income flow, tax efficiency, and cost of investing.

With respect to the cost of investing, investors are often shocked when we illustrate the amount they have been paying in fees. In some situations, the reason fees are higher than they thought is the use of structured or pooled investments such as mutual funds.

The Greenard Group’s model portfolios do not include any mutual funds. We have transitioned hundreds of clients out of mutual funds and into direct holdings to reduce their costs of investing.

Thankfully, in a few years time, the cost of investing will become clearer to a lot of investors. That’s because on April 20, 2023, the Canadian Securities Administrators (CSA) and Canadian Council of Insurance Regulators (CCIR) approved new disclosure requirements for mutual funds, exchange-traded funds (ETFs), and segregated funds on investor’s statements. After years of consultations with investor advocates and market participants, and with insights from behavioural psychology, they announced that enhanced fee disclosures will be required starting in 2026.

There are basically two main changes in the new regulations: regular statements will have to include fund expense ratios, and end-of-year statements will have to include the dollar amount of the total fee charged by the fund company. Stating fees as a total dollar amount as opposed to a percentage provides better clarity. To understand these changes better, we should first understand the fee structure of the typical mutual fund.

The total cost of investing in mutual funds generally includes:

- The Management Expense Ratio (MER), and

- The Trading Expense Ratio (TER)

The TER is very easy to understand. It represents the amount of trading commissions incurred when the portfolio management team buys and sells assets within a given fund.

The MER, on the other hand, is made up of several components. It includes the trailing commission, investment management fee, operating costs, and taxes. It usually varies between 1 per cent and 3 per cent. The trailing commission is an ongoing charge for services and advice provided by your advisor and their firm, and usually varies between 0.25 per cent and 1 per cent.

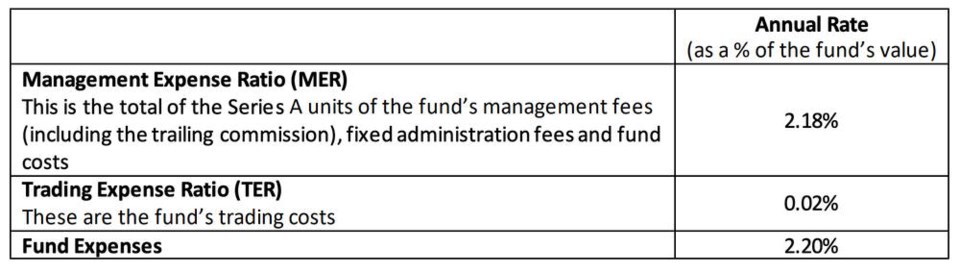

To illustrate these changes, we will look at the most common scenario of a retail investor holding the Series A of a mutual fund with his bank:

So far, so good. Investors are informed of the fees at the time of purchase. Unfortunately, this information is not given to investors again. All of their statements would show the mutual fund as a holding but won’t have information on the fund expenses again. Investors need to proactively search or ask for this information. In conversations with prospective clients, it’s clear that even when asking their existing advisors, they have not always obtained full disclosure of their total fees.

With the new regulations, every statement will have to include the fund expense ratio in it. This will serve as a constant reminder for investors of the costs of this investment.

Total cost of investment in end-of-year statement

As it stands today, investors receive monthly or quarterly statements from their investment firms. Once a year, on the last statement of the year, investment firms are required to inform investors of the total dollar amount of the trailing commission paid to their firm. Notice that they are only required to disclose the trailing commission amount, not the entire fee. As we’ve seen above, the trailing commission is only a part of the total cost of the fund.

So, assuming the fund’s trailing commission is 1 per cent, and the investor has $500,000 invested, the amount that will be reported on their end-of-year statement is only $5,000, when in fact the total cost of the fund (2.20 per cent) was $11,000, understating the total fee by $6,000.

Even though there is usually a text on the statement explaining that this amount refers to the trailing commission, you could argue that a lot of investors are not familiar with the structure of mutual fund fees and, as a consequence, might think that the amount refers to the total fee they are paying for that mutual fund. We feel that sending out statements with only part of the total fee is very misleading.

The new regulations will require that the dollar amount of the total fee be included in the statement. It will give investors a true picture of the costs of their investments.

Although it is frustrating that these changes will take a long time to be in effect, we are happy that our regulators continue to implement changes to protect and benefit investors. The world of investing can be quite complex as it is. Any change that increases transparency and helps investors make informed decisions is welcomed.

Kevin Greenard CPA CA FMA CFP is a Senior Wealth Advisor and Portfolio Manager, Wealth Management with The Greenard Group at Scotia Wealth Management in Victoria. His column appears every week at timescolonist.com. Call 250-389-2138, email [email protected], or visit .