There are many ways households can income split to lower their overall tax bill: Spousal Registered Retirement Savings Plans (SRSPs), ÎÚÑ»´«Ã½ Pension Plan (CPP) sharing, spousal loans, and pension income splitting, to name a few.

With pension income splitting, the higher-income spouse or common-law partner transfers income to the lower-income spouse or common-law partner. For the past 15 years, Canadian residents have been able to benefit from the pension income splitting rules that came into effect in 2007. These rules allow Canadians to transfer up to 50 per cent of their eligible pension income to their spouse or common-law partner.

There are many ways to manage your tax liability and pension income splitting may be one of the useful tools to help achieve this with significant tax savings.

Who qualifies for pension income split?

With pension income splitting, the transferring spouse or common-law partner is the higher-income earner and can transfer up to 50 per cent of their pension to the receiving spouse or common-law partner, the lower-income earner. In order for this to be permitted, all of the following criteria must be met:

• You and your spouse or common-law partner were not living separate and apart from each other, because of a breakdown in your marriage or common-law partnership, at the end of the tax year and for a period of 90 days or more beginning in the tax year. If you are living apart for medical, educational, or business reasons, pension splitting is still permitted.

• You and your spouse or common-law partner were residents of ÎÚÑ»´«Ã½ on Dec. 31 of the year, or:

• if deceased in the year, resident in ÎÚÑ»´«Ã½ on the date of death.

• if bankrupt in the year, resident in ÎÚÑ»´«Ã½ on December 31 of the year in which the tax year (pre• or post-bankruptcy) ends.

• You received pension income in the year that qualifies for the pension income amount, or you were 65 years of age or older and received certain qualifying amounts distributed from a retirement compensation arrangement (Box 17 of your T4A-RCA slips).

What type of pension income qualifies?

A general rule of thumb is that if the pension income is eligible for the federal pension income credit of $2,000, it can be split. The type of qualifying income depends on if you are 65 years of age or older, or less than 65 years of age, as follows:

65 years of age or older

• Registered Retirement Income Fund (RRIF) income; except any portion transferred to a Registered Retirement Savings Plan (RRSP), a RRIF, or to purchase an annuity;

• RRSP income;

• Registered Pension Plan (RPP) lifetime retirement benefits (includes retroactive lump sum payments);

• Foreign pensions, including US Social Security (only the amount that is not deductible on line 25600 – Additional Deductions is eligible);

• Regular annuities and Income Average Annuity Contracts (IAAC);

• Deferred Profit-Sharing Plan (DPSP) income;

• Employee Benefit Plan (EBP) benefits (unless there is a box 109 on the T4A slip, the applicable amount in box 016 is not considered eligible pension income); and

• Variable pension benefits.

Less than 65 years of age

• RRIF income, as a result of the death of a spouse or common-law partner (except any portion transferred to a RRSP, a RRIF, or to purchase an annuity);

• RRSP income, as a result of the death of a spouse or common-law partner;

• RPP lifetime retirement benefits (includes retroactive lump sum payments);

• Foreign pensions, including US Social Security (only the amount that is not deductible on line 25600 — Additional Deductions is eligible);

• Regular annuities and IAAC, as a result of the death of a spouse or common-law partner;

• DPSP income, as a result of the death of a spouse or common-law partner;

• EBP benefits (unless there is a box 109 on the T4A slip, the applicable amount in box 016 is not considered eligible pension income); and

• Variable pension benefits, as a result of the death of a spouse or common-law partner.

What type of pension income doesn’t qualify?

There are several types of pension income that do not quality to be split, as follows:

• Old Age Security (OAS) payments;

• CPP amounts (CPP is instead shared with your spouse or common-law partner – more information on CPP sharing can be found in our article here);

• Any foreign source pension income that is tax-free in ÎÚÑ»´«Ã½ because of a tax treaty that entitles you to claim a deduction on line 25600 – Additional Deductions;

• Income from a United States Individual Retirement Account (IRA);

• Lump-sum RRSP withdrawals; and

• Amounts from a RRIF included on line 11500 — Other pensions and superannuation, and transferred to an RRSP, another RRIF, or an annuity.

How it works — pension splitting illustrated

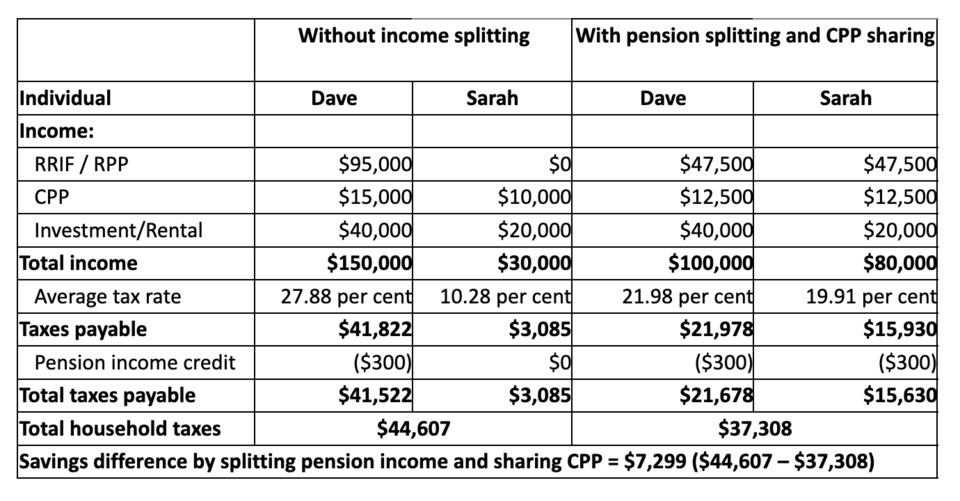

Dave is 68 and Sarah just turned 65. With Sarah turning 65, they are now eligible to pension split. Since Dave and Sarah do not require OAS for cash flow purposes, they have both decided to defer receiving their OAS until age 70 in order to receive 36 per cent more OAS.

As you can see from the below example, by transferring half of Dave’s RRIF and RPP income to Sarah, they can save a combined $7,299 each year. Included in this is the pension income credit of $300 ($2,000 x 15 per cent) which Sarah is now eligible for. She would also be eligible for the provincial pension income tax credit; however, for simplicity of this example we have not included it below.

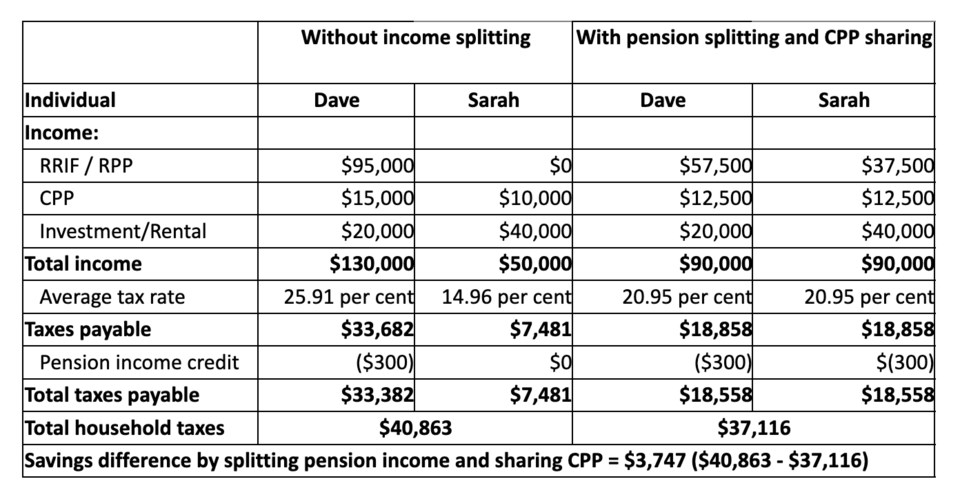

Say instead of Dave earning $40,000 of investment and rental income and Sarah earning $20,000, that it is flipped: Sarah is the one earning $40,000 of investment and rental income and Dave earns $20,000. In this instance, it would not make sense for Dave to share the full 50 per cent of his qualified pension income because it would result in Sarah having a higher income than Dave.

When income splitting, the goal is always to try and equalize incomes. In this case, to equalize incomes, Dave needs to split 39.47 per cent of his qualified pension income for him and Sarah to arrive at the same total income figure as shown below:

It’s also important to note that the bigger the discrepancy in incomes, the bigger the savings may be. In the first example above, the difference in incomes is $120,000 ($150,000 - $30,000) and that results in savings of $7,299. In the second example above, the difference in incomes is $80,000 ($130,000 - $50,000) and results in $3,747 of savings.

How do you elect to pension split?

After looking through the above examples, if you think pension income splitting may benefit your tax situation, the steps to pension split are quite simple.

With pension splitting, the money is not physically transferred from the transferring spouse to the receiving spouse. Instead, annually a joint election is made when filing your tax return using Form T1032, Joint Election to Split Pension Income, so it is only an allocation on paper to reduce taxes payable for the household.

Since the election must be made annually, it allows for flexibility to determine the optimal amount of pension income to split, and the same percentage does not have to be used each year.

Before you get started, we recommend having all of your and your spouse or common-law partner’s tax slips handy. This includes any T4RIF, T4RSP, T4-RCA, T4A, T3, T5 and details of foreign pension income.

We recommend speaking with your tax advisor to determine if pension splitting is right for your individual tax situation.

Kevin Greenard CPA CA FMA CFP CIM is a Senior Wealth Advisor and Portfolio Manager, Wealth Management with The Greenard Group at Scotia Wealth Management in Victoria. His column appears every week at timecolonist.com. Call 250-389-2138, email [email protected], or visit .