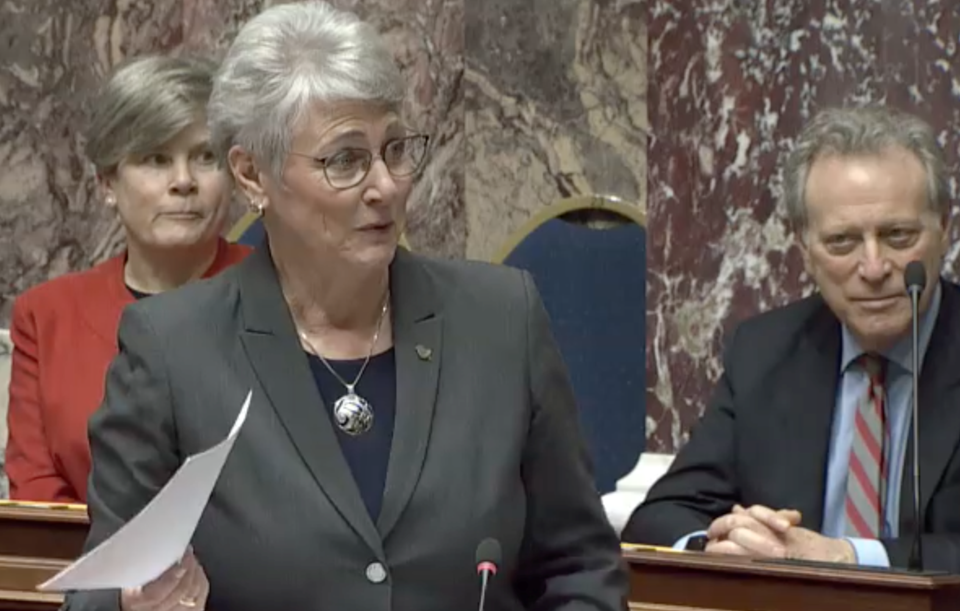

ÎÚÑ»´«Ã½ Finance Minister Katrine Conroy brought down a recession-geared budget Tuesday that is heavy on social spending and public sector pay increases, and projects deficits for at least three more years.

“This year’s budget improves health care, builds more homes, helps with rising costs and ensures our communities are safe,” Conroy said.

The budget anticipates a slowing economy and falling revenues from taxes and natural resources.

Apart from the annual 15 per cent increase in carbon taxes, there are no new taxes or major tax increases in this year’s budget.

Nor are there any major tax breaks, although heavy industry in ÎÚÑ»´«Ã½ may welcome a new output-based pricing mechanism for carbon taxes previewed in the budget, and schedule to take effect in 2024.

Business leaders did not expect any tax breaks in this year’s budget, but had hoped the government would at least consider moving the threshold up for employers required to pay the employee health tax. However, there is no change to the employer health tax, which replaced the previous Medical Services Plan (MSP) and shifted the burden for the health care premiums onto employers.

The budget is heavily focused on spending for health care, housing and social programs. It contains $1.4 billion in new operating and capital spending this year. It includes a long-promised $400 renter’s rebate.

The government plans to spend $81.2 billion in 2023-24, but raise only $77.7 billion, leaving a $4.2 billion shortfall. The budget projects deficits for the next three years – starting at $4.2 billion for 2023-24 and declining to $3 billion in 2025-26.

Business groups have been urging fiscal restraint, saying increased public spending in inflationary times is at odds with the Bank of ÎÚÑ»´«Ã½’s attempts to cool inflation with interest rate hikes.

In a scrum with reporters prior to her budget speech, Conroy defended her plan to continue to spend more than the government takes in for at least three more years.

“I think we’ve proven during the pandemic that we can incur deficits by supporting people, but we still have a strong economy,” Conroy said. “It’s just not the right time to start making cuts.”

Capital spending will increase by $10 billion over the previous budget to $37.5 billion over three years.

A $5.7 billion surplus forecast in the second quarterly financial update has been whittled down to $3.6 billion, thanks to new spending announced recently by Premier David Eby, including a $500 million rental protection fund and a second round of “affordability” credits that will cost $500 million.

Any unspent funds from the surplus at the end of the year will go to paying down the provincial debt, which is expected to grow from $63.7 billion in 2022 to $75.6 billion in 2023-24 – a debt Conroy said “remains manageable.”

Taxpayer supported debt is forecast to hit $99.4 billion by 2025-26, which would put the province’s debt-to-GDP ratio at 23 per cent.

The budget includes a big cushion in the form of $5.5 billion in contingencies, including a $700 million forecast allowance for 2023-24. That includes contingencies for a Shared Recovery Mandate to accommodate public sector wage increases. In total there is $15 billion over three years for the Shared Recovery Mandate.

The budget has some measures to address a skilled labour shortage. Of the $1.4 billion in new operating and capital spending for 2023-24, $480 million is earmarked for post-secondary trades and skills training, and includes funding to help small and medium-sized business address labour market challenges.

The budget sets aside $58 million over three years to speed up credential recognition for immigrants in areas such as health care and child care.

Economy expected to slow

ÎÚÑ»´«Ã½’s economy grew by 2.8 per cent in 2022 but the budget anticipates growth in 2023 to slow to just 0.4 per cent. ÎÚÑ»´«Ã½’s GDP is expected to grow by 1.5 per cent in 2024 and 2.4 per cent in 2025.

The budget projects resource sector revenues will decline 21 per cent in 2023. It anticipates less natural gas drilling, with revenues from bonus bids to fall from $131 million in 2022-23 to $77 million in 2025-26.

The budget forecasts royalties from natural gas to decline from $2.2 billion in 2022-23 to $1.5 billion in 2025-26.

It also expects lower revenues from mining – a 19 per cent decline in 2023-24 due to lower expected prices for copper and metallurgical coal, two of ÎÚÑ»´«Ã½’s most valuable exports.

Forestry revenue is expected to decline 54.4 per cent in in 2023-24 as a result of lower harvesting of Crown forests and lower stumpage rates. That is somewhat self-inflicted, as the ÎÚÑ»´«Ã½ government’s old growth deferral plan will remove large volumes of harvestable timber from the harvest base.

The budget sets aside $77 million to speed up natural resources permitting to address backlogs and includes $6 million over three years for a new critical minerals strategy.

It includes previously announced funding of $185 million for the forestry sector to incentivize investments in higher value-added wood manufacturing and mill retooling to address a decline in old growth timber.

The budget includes $40 million in subsidies for businesses and non-profits to invest in zero emission vehicles.

New industrial carbon tax scheme introduced

ÎÚÑ»´«Ã½’s carbon tax will increase by $15 per tonne on April 1, but the budget sets the stage for a change to the way the biggest emitters – heavy industry --pay the provincial carbon tax.

Starting in 2024, a new output-based carbon-pricing system for heavy emitters will go into effect. It will exempt heavy emitters from paying the carbon tax up front and will instead set the price they pay based on a company’s reported emissions, with the price they pay based on whether they meet or exceed established emissions intensity benchmarks.

“If you bring innovation to your industry, innovation to lower your carbon taxes, you will pay less,” Conroy explained.

She added the move to output-based pricing is federally mandated, so the new scheme is part of harmonizing ÎÚÑ»´«Ã½’s carbon pricing system with the federal government’s.