Who is the former RCMP officer — who has previously worked for the Chinese government — charged with foreign interference on behalf of China?

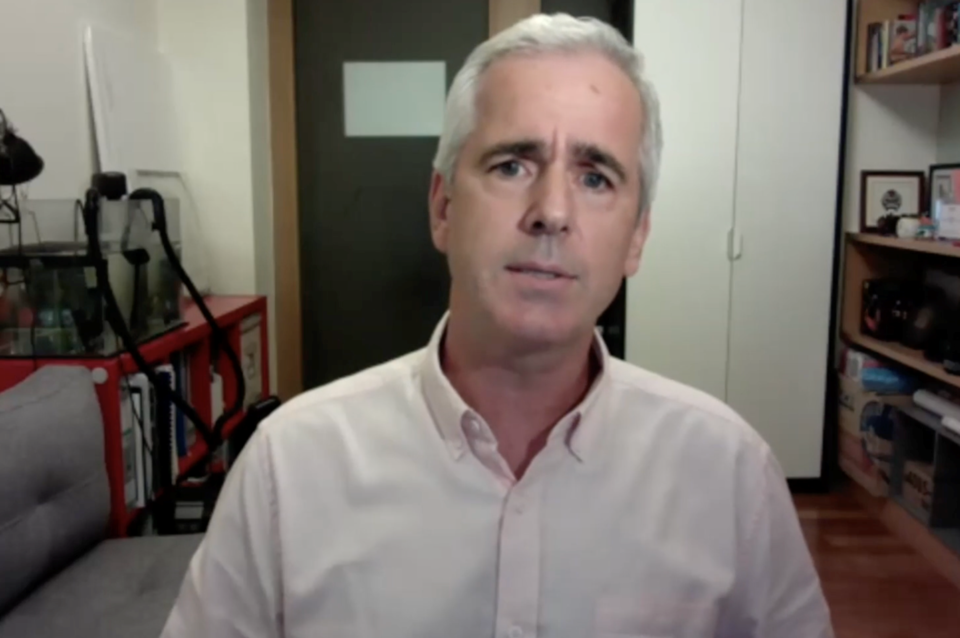

Bill Majcher appeared by video in a Longueuil, Que., courthouse on Friday. According to an announcement from the RCMP, the 60-year-old “allegedly used his knowledge and his extensive network of contacts in ÎÚÑ»´«Ã½ to obtain intelligence or services to benefit the People's Republic of China.”

The Integrated National Security Enforcement Team (INSET) investigated Majcher under the Security of Information Act since fall 2021 and found evidence that he helped the Chinese government “identify and intimidate an individual outside the scope of Canadian law.”

Nova Scotia-born Majcher was originally schooled in commerce and his first job after university came as a 22-year-old Euro bond trader in London. In a sworn affidavit from July 2017, the Hong Kong resident said he joined the RCMP on July 19, 1985 and retired Aug. 15, 2007.

He claimed the RCMP, FBI and other police forces commended him with several letters “meritorious service” after a career in which he worked undercover to infiltrate and surveil major organized crime and money laundering operations in ÎÚÑ»´«Ã½, U.S. and overseas.

That included acting as frontman for a Colombian cartel and busting Martin Chambers, a corrupt Vancouver lawyer, for money laundering in 2002. He took a promotion to head the Integrated Market Enforcement Team, but lost that job in 2005 after he launched a failed campaign to become the Conservative nominee in Richmond.

“Since retirement I have assisted several government agencies on matters related to UN sanctions pertaining to development of nuclear weapons, the World Bank’s stolen asset recovery initiative, and government kleptocracy and money laundering,” Majcher’s affidavit said.

Majcher also went into finance and venture capital. The month after he left the Mounties, he was the managing director (international) for Hong Kong investment bank The Baron Group and was appointed a director of Evolving Gold Corp., a Vancouver-based, TSX-V-listed stock.

In 2012 filings, Evolving Gold told shareholders that Majcher was CEO of Sunwah International Asset Management, focused on natural resources and emerging markets. He was also described as the executive chairman of China Investment Fund, listed on the Hong Kong Stock Exchange, and a director of an unnamed “China-focused private equity fund.”

According to his LinkedIn profile, Majcher co-founded EMIDR Ltd. (which stands for Evaluate Monitor Investigate Deter Recover), a corporate risk advisory firm focused on asset recovery and cybersecurity. His bio said EMDIR worked closely with governments to tackle financial crime, money laundering and tax evasion.

In the 2017 affidavit, he recounted working undercover at the Winnipeg Commodity Exchange for three years on a joint RCMP-FBI investigation. He claimed that he gained evidence of collusion among corrupt judges, lawyers and court registry staff in various parts of ÎÚÑ»´«Ã½, but did not name names.

“When those members of the criminal underworld want a case heard by a specific judge they are able to use one of these lawyers to facilitate a friendly judge to be assigned to their case,” said Majcher’s affidavit.

“In several instances, my co-workers and I reported our concerns about corruption in the administration of justice to senior members of the RCMP and [Department of Justice], who refused to investigate or bring charges against any of the lawyers, judges or court registry staff involved in the corruption.”

Majcher expanded on those allegations about commodity trading crimes during a May 2022 podcast from HKU FinTech, called “Regulatory Ramblings.”

“The reality is, if they had have charged one, they'd have to charge everybody. And I did illegal acts with about 85% of the members of that exchange. So, if we had have, again, charged them all overnight, it would have ended ÎÚÑ»´«Ã½'s ability to have independent pricing mechanism for all our commodities, physical commodities,” Majcher said.

Perhaps most-revealing, however, are the minutes from a Feb. 27, 2019 meeting in the House of Lords of the United Kingdom All-Party Parliamentary Group on cybersecurity. The topic: “How do we bridge the growing cyber trust deficit between China and the West?”

Majcher was the featured guest speaker and told the meeting chaired by Lord Mackenzie of Framwellgate that he had become mostly focussed on money laundering matters with one major client: the Chinese government.

“Bill is working on the return of US$1.2 trillion of fraudulently acquired money,” said the minutes.