Vancouver taxpayers could be looking at a property tax increase of 7.6 per cent in 2024, if city council decides to adopt a recommendation outlined by the city’s finance team in a

Such an increase would come one year after council approved , with Mayor Ken Sim and his ABC Vancouver majority at city hall prioritizing the hiring of police officers, firefighters and mental health workers.

has also seen investment.

At least 2.8 per cent of the proposed 7.6 per cent increase would go to the Vancouver Police Department’s operating budget, which is expected to increase from this year’s $373.5-million budget by $30 to $36 million for 2024.

Council will debate the final number at a special budget meeting scheduled for Dec. 5.

At the same time, both the VPD and Vancouver Fire and Rescue Services are predicting their respective departments will go over budget this year — the police department by $3.6 million and fire service by $3.3 million.

The deficits come despite both departments receiving to their 2023 budgets.

A separate report that goes before council Nov. 28 says the VPD experienced significant cost pressures this year related to “global political tension.”

The report didn’t elaborate but Police Chief Adam Palmer said at a police board meeting last month that the Israel-Hamas conflict “is taking up a lot of our time right now. It's probably our number one priority that we're dealing with.”

“This is going to be a budgetary issue because it's significant callouts [of officers], but we're not going to scrimp on public safety,” Palmer told the board Oct. 19. “And we're going to make sure that we've got the right resources out there to keep the community safe.”

In addition, the VPD has incurred overtime costs for its deployments related to the East Hastings Street encampment “as well as other cost pressures partially offset by salary savings due to staffing vacancies.”

The fire department’s $3.3-million deficit is primarily due to overtime caused by staff absenteeism driven by higher injury claims and sick leaves.

“While the department has vacancy savings from delayed hiring and above budget cost recoveries, there are also higher than budgeted costs incurred for supplies and materials due to compliance with higher safety standards, the need for improved technological devices (AEDs), higher first aid supplies and security costs at ,” the report said.

The staff report recommends the deficits be covered as “one-time budget adjustments.”

Police and fire departments account for 29 per cent of total spending in the 2024 draft operating budget.

'Smartest people in the country'

At the Nov. 28 meeting, council will also receive a presentation from Sim created earlier this year to examine the city’s finances, with the premise being savings could be found in what the city spends money on each year.

In an this month, Sim said the task force is comprised of “24 of the smartest people in the country.” The mayor said the task force was given “no guardrails” in its goal to find “areas of opportunities.”

“What's going to happen is one of two things — they're literally going to say, ‘No, this place is running incredibly well and there's nothing else we can do,’” he said.

“Or they're going to say, ‘Hey, there's a lot of opportunities, and this is what we should do.’ Either way, we're going to have our answers, and then we're going to have to deal with it as mayor and council.”

The estimated worth of the 2024 operating budget is $2.15 billion, an increase of approximately $193 million over the 2023 budget.

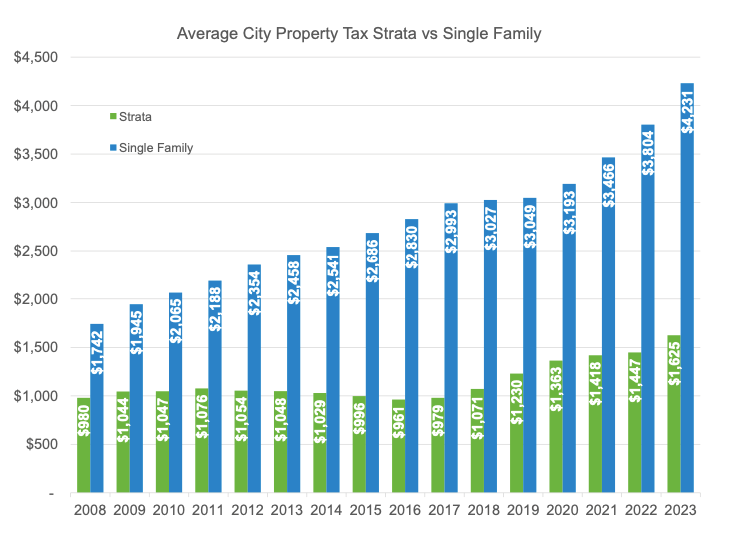

If a 7.6 per cent tax hike is approved, it would cost the owner of a median strata unit an estimated $100. It would be $263 for a median single-family property, and $478 for a median commercial property in 2024.

The increase doesn’t factor in utility fees and other taxes paid to the provincial government, TransLink, BC Assessment, Metro Vancouver and the Municipal Finance Authority of BC. Like taxes, utility fees are expected to increase annually, with seven per cent the estimate through to 2028.

The staff report said the utility hikes are driven primarily by forecasted increases in regional utility charges from Metro Vancouver and increased investments in infrastructure renewal, which includes the

Housing top priority

Meanwhile, the city’s 2023-2026 capital plan was approved by council in June 2022 and contemplates $3.5 billion worth of capital investment over four years. Staff recommends a net increase of $14.4 million to the plan in 2024.

Earlier this year, a total of 2,845 residents and 502 business owners completed the city’s annual budget survey, which was offered in English, simplified Chinese, traditional Chinese and Punjabi.

The survey found the number one budget priority for both residents (70 per cent) and businesses (62 per cent) was housing. This is followed by infrastructure and transportation and equity and social issues.

Residents were most likely to support an increase in business or commercial property taxes while business operators said they preferred new and increased user fees.

Just over half (53 per cent) of strata property owners agreed with a property tax increase in the range of $64 and $103 for 2024. Four out of 10 (39 per cent) owners of single-detached homes agreed with a property tax increase between $169 and $270.