Just a few weeks into the year, optimism regarding Metro Vancouver’s real estate outlook is muted.

The first quarter has yet to deliver the level of activity many brokers anticipated, and many now anticipate better times to occur after mid-year.

“Generally, people feel better about this year, but it’s been a slower Q1 than we were expecting,” said Jason Kiselbach, executive vice-president and managing director with CBRE Ltd. in Vancouver. “We’re still projecting that the back half of year is going to be really active both in sales and leasing as we start to get the direction of changes on interest rates. That will get people off the sidelines and more deal activity starting up.”

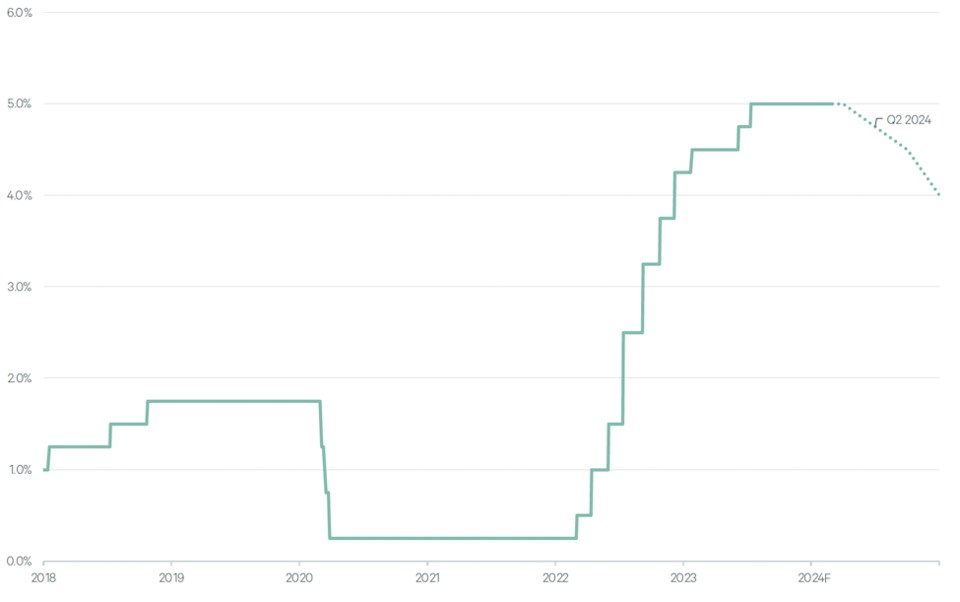

Most observers don’t expect any cuts to interest rates before the Bank of ÎÚÑ»´«Ã½’s announcement on Apr. 10, when it will also deliver a monetary policy report. Additional announcements will follow on June 5 and July 24, by which time most observers expect cuts to be in play.

CBRE’s real estate market outlook, released Feb. 27, expects cuts June 5, with a percentage point drop in the following six months to put the central bank’s policy rate at 4 per cent by the end of the year.

“That would really move the dial in terms of urgency in the market, deal activity,” Kiselbach said.

The deals that get done will give investors a read on the state of the market. A few big deals are set to complete in the next few weeks, such as the sale of 402 Dunsmuir Street and 401 West Georgia Street, which will help the market get a read on the value of major assets in the current environment. A few major land transactions are also in the offing after a year of crickets.

“Nothing traded, so you don’t know the value of properties,” Kiselbach said. “I think Q1, Q2 is going to be about some of these deals finally closing, and getting a better read on what some of these properties are worth.”

On the leasing side, office vacancies are stable while the industrial market continues to right-size.

“Vacancies are at the top of where they’re going to go,” Kiselbach said of the office market in the core. “Every week our office group says tour activity is picking up, there’s a few more offers starting to be drafted.”

With no new supply in the pipeline for downtown, the activity points to vacancies continuing the decline initially reported in the final quarter of 2023. CBRE’s forecast calls for downtown vacancies to end 2024 at 10.9 per cent, offset by softer conditions in the suburbs where space continues to complete but absorption is slower.

On the industrial side, vacancies also increased last year, thanks in part to the addition of 7.2 million square feet, the most ever delivered in a single year, coupled with a pullback in demand.

This year, new space is estimated at 4.5 million square feet, while vacancies will rise to 4.3 per cent prior to coming down in 2025.

“The supply side is starting to slow down, the activity is picking up from tenants and purchasers, so you’ll see a normalization of vacancy.”