ÎÚÑ»´«Ã½ is looking to expand its capacity to export liquified natural gas at a time when a “glut” of competition could strangle the province’s ability to recoup its investment, a new study has found.

The report, produced by the U.K. firm Carbon Tracker on commission from the David Suzuki Foundation and the Pembina Institute, found all of ÎÚÑ»´«Ã½’s proposed liquified natural gas (LNG) projects are at risk of generating lower than expected returns as they arrive as a “late entrant” in markets already dominated by lower-cost, more established producers.

Unsanctioned projects — which would exclude facilities such as LNG Phase 1 and Woodfibre — were forecast to produce gas 26 per cent more expensive than the global average. ÎÚÑ»´«Ã½ gas was forecast to cost up to 80 per cent more when compared to gas from bulk producers in the U.S., Mozambique and Qatar.

Thomas Green, the senior climate and policy advisor for the David Suzuki Foundation, said the report shows the international gas market will face oversupply by the end of this decade.

“It really is a risky time to double down on further LNG expansion,” Green said.

“The revenue streams that government has been counting on will likely not materialize and the projects may not end up in the black.”

A spokesperson for ÎÚÑ»´«Ã½'s Ministry of Energy, Mines and Low Carbon Innovation declined to respond to Glacier Media's request for comment until government formed and the minister was sworn in.

Maeve O’Connor, a Carbon Tracker analyst and author of the report, wrote the case to invest in more gas is often underpinned by assumptions that demand in LNG will rise, mostly in Asia, and that current supply will be enough to meet future demand.

“However, demand projections from both the industry and forecasting agencies indicate otherwise,” concluded O’Connor, who previously worked in financial market policy at the European Central Bank and in corporate finance and trading at the Bank of Ireland.

Gas producers in Western ÎÚÑ»´«Ã½ are already facing months of low prices amid a supply glut. That has prompted some companies to delay their growth plans or shut down production altogether. Some have pinned their hopes on projects like LNG ÎÚÑ»´«Ã½ Phase 1 to catalyze a rebound in prices.

O’Connor points to outlooks from the fossil fuel company BP which show gas demand has fallen 17 per cent between 2019 and 2023. The International Energy Agency, for its part, has revised its forecasts and now expects gas demand to plateau by 2030, notes the report.

Meanwhile, the report found gas faces “stiff price competition” from coal, nuclear and renewable energy.

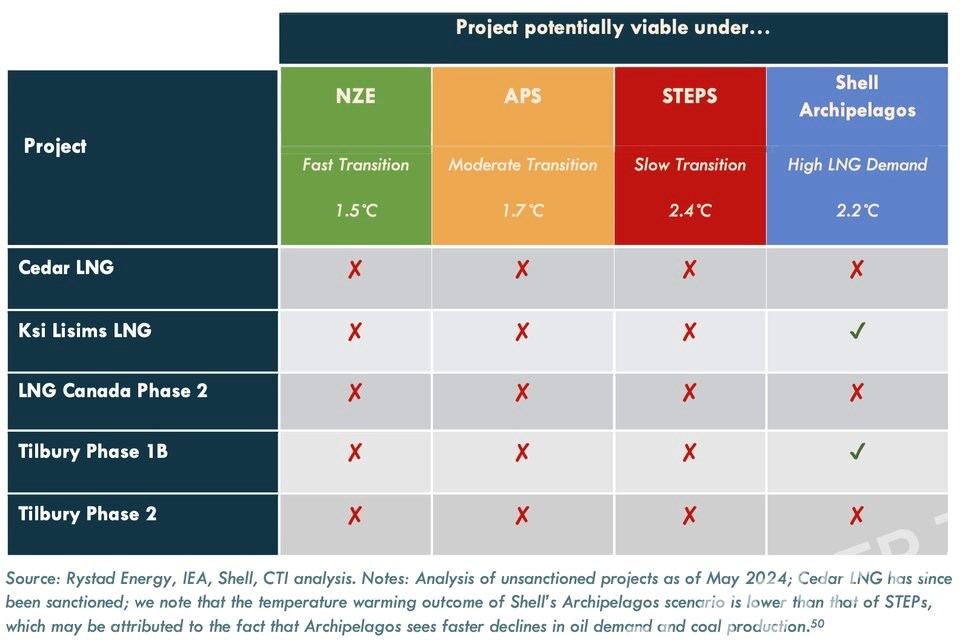

Carbon Tracker found that even under a more bullish forecast of gas prices, all but two proposed LNG projects — Ksi Lisims and Tilbury Phase 1B — would be at risk of generating lower than expected returns.

“Policy makers in ÎÚÑ»´«Ã½ should be aware that long term fiscal revenue streams from LNG are far from guaranteed,” O’Connor wrote.

They should also be aware, added the Carbon Tracker analysis, that “new LNG projects could put considerable strain on ÎÚÑ»´«Ã½’s existing power infrastructure.”

LNG footprint

Outside a pure economic argument, Green also pointed to a growing body of research that shows gas might not be as low-carbon as once thought.

A peer-reviewed published earlier this month by Cornell University professor Robert Howarth found the export of LNG from the United States produced more emissions than coal.

“Even considered on the time frame of 100 years after emission…which severely understates the climatic damage of methane, the LNG footprint equals or exceeds that of coal,” concluded the study.

The main ingredient in gas is methane. When it leaks into the atmosphere, it acts as a greenhouse gas 80 times more powerful than carbon dioxide over the first 20 years that it’s in the atmosphere.

Green said research has increasingly found more methane leaks along the supply chain than once thought — such as during extraction, as it runs along pipelines or when it’s shipped overseas.

As a weakened BC NDP government begins to set up for a third term following a razor-thin election victory, the BC Green Party could play an outsized role in swaying the balance of power in the Legislature. Even with that role, however, it's not clear they would expend political capital pressuring the NDP to steer support away from LNG projects.

With affordability a key election issue for many British Columbians, Green said it doesn't make sense to make affordability worse in the province by tying up electricity supply in LNG projects.

“Our hope is that the folks in Victoria realize that industry marketing materials and promises of riches and claims that there's all this demand don't withstand scrutiny,” Green said.

“It doesn't make sense to use public dollars to support any of these projects to go ahead.”

With files from the Canadian Press