In 2021, inflated valuations and unsustainable growth fuelled by a tech sector bubble left many technology companies bloated.

More than a dozen ÎÚÑ»´«Ã½ companies attracted venture capital financing that pushed them into unicorn status—a private valuation of $1 billion or more—and a number of local tech companies went public.

And then the bubble burst.

In the spring of 2022, technology stocks began to plunge as inflation, rising interest rates and recession jitters sent investors into safer havens, and technology companies were forced to resort to massive layoffs.

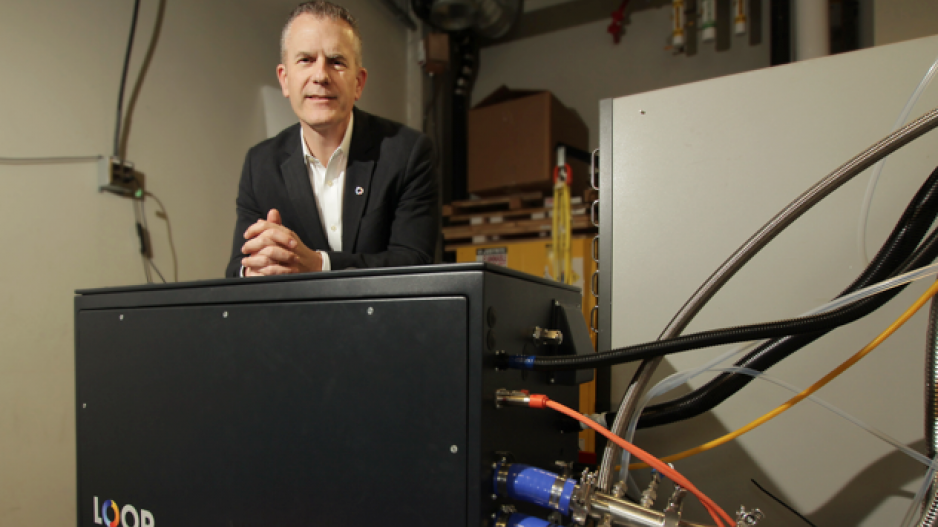

Loop Energy (TSX:LPEN), for example, a Burnaby-based hydrogen fuel-cell company, debuted on the Toronto Stock Exchange (TSX) in 2021 at a price of $16.45 per share. It now faces possible de-listing.

The company cut 65 per cent of its headcount in 2023, and as of last week, its stock was trading at below $0.04 per share.

A brutal two-year bear market for the tech sector may not be over just yet, either, despite some recent major financings and acquisitions that might suggest a recovery.

Brent Holliday, CEO of Garibaldi Capital Advisors, said he believes that 2024 will be a year of “cleansing” and “fire sales” that will see a winnowing of technology startups.

“This is the year of the great tech cleanse, and we’re going to come out the other side with less companies, less jobs—except now we have less companies in a market that starts to grow again,” he said.

“I lived through the dot-com boom and bust and the 2007-2008 correction and now this one,” said Rob Goehring, CEO of Wisr AI. “This one was bad.

“I’ve never had so many people that I’m close to have to either shut the company down or put it into some sort of low-growth stasis mode and ride it out, or accept a really tough down-round of venture capital just to keep alive.”

“We were in a very long up-cycle in tech, and got the COVID bump as well, and then fell harder, maybe, than other sectors because of the COVID bump,” said Maria Pacella, managing partner PenderFund Ventures, an early investor in Copperleaf Technologies (TSX:CPLF)—one of a few bright spots in what has otherwise been a very dark time for tech sector financing.

A $1 billion play by international enterprise software giant IFS for Vancouver-based Copperleaf, and a US$104 million private financing round for Vancouver medical device company Kardium, offer some hope that the bear market may end sooner than later for ÎÚÑ»´«Ã½’s tech sector.

“I do think there is some cautious optimism,” Pacella said. “I think the backdrop is there’s still some uncertainty out there. I don’t know if it’s too soon to say we’ve turned the corner, but certainly I think it’s more optimistic than 2023.”

CopperLeaf was among a handful of Vancouver companies that went public in 2021.

When it went public on the TSX, Copperleaf’s shares were priced at $24.70, which would have given it a market cap of $1.8 billion. That price shows just how frothy the tech market had become 2021.

“There was crazy stuff going on,” Holliday said. “Companies were raising $100 million and they had, like, $4 million of revenue. It was nutty. The bubble had to burst at some point.”

Copperleaf’s shares sank as low as $3.60 per share in October 2022.

Last week, the company’s stock was up to $11.87 per share and its market cap sat at around $881 million. The $1 billion offer from IFS represents an 18-per-cent premium over its June 10 value and a 70-per-cent premium over its share price on May 3, just before IFS made its offer.

“CopperLeaf went public for the right reasons, was always a good company, had demonstrated they could be a profitable before they went public, but were investing for growth,” Pacella said.

Tech stock indexes that are up in 2024 might suggest the technology bear market is over, and for bigger companies and companies in the AI space, that may be true.

But it’s a very different story in the private market.

“What’s going on in the public markets and the private markets is vastly different,” Holliday said.

When the 2022 correction occurred, tech companies were told to try to get 18 to 20 months’ worth of financing, Holliday said. The thinking was that they would only need that much runway before inflation and high interest rates ran their course.

“Well, inflation was a bit more [of] a bugger and was more sticky,” Holliday said.

The result is that many tech startups burned through their cash, and many had to resort to layoffs. The job markets for some ÎÚÑ»´«Ã½ technology subsectors remain stagnant, and it’s particularly bad for video game studios.

On June 11, for example, U.K.-based Sumo Group announced it was laying off 15 per cent of its global workforce, which included the closure of Timbre Games in Vancouver.

“We aren’t seeing large-scale layoffs this year,” said Stephanie Hollingshead, CEO of TAP Network, a tech-sector-focused human resources company. “Instead, most companies are finding other ways to cut costs and operating with some pretty tight budgets.”

Hollingshead said layoffs are concentrated in gaming, with companies such as Burnaby-based Phoenix Labs and Vancouver-based A Thinking Ape recently going through fairly significant layoffs.

“Two years ago, almost 90 per cent of the tech companies in our survey were anticipating headcount growth over the next two years,” she said. “We asked again this spring, and this time only half the companies stated they’re expecting headcount growth over the next two years.”

Not all tech companies are struggling.

Thinkific Labs Inc. (TSX:THNC), a platform that allows businesses and educators to develop online courses and tutorials, was among the herd of ÎÚÑ»´«Ã½ unicorns that went public in the spring of 2021, raising $160 million in an initial public offering. Nearly a year later, it laid off 20 per cent of its workforce.

The company turned a corner in the last quarter of 2023, posting a small net profit for the first time since going public in 2021. It is also rehiring and its stock price has recovered to around $3.70 per share since bottoming out at $1.40 per share in December 2022.

“There was a downturn in the overall tech market for sure that hit everyone in ‘21, but just looking over the last 24 months, we’ve been nothing but up,” said Thinkific CEO Greg Smith.

Going forward, artificial intelligence companies are expected to give the tech sector a lift.

“It’s going to be a giant wave, and it’s going to support the next tech cycle,” Smith said.