The space technology firm that got its start in Richmond has secured a sky-high selling price of US$6.4 billion.

Maxar Technologies (NYSE:MAXR) (TSX:MAXR) revealed Friday it’s the target of an all-cash deal that would see it acquired by global equity firm Advent International, with British Columbia Investment Management Corp. (BCI) taking a minority stake worth US$1 billion.

The Victoria-based institutional investor provides investment management services to ÎÚÑ»´«Ã½’s public sector and contributes to investment returns on 715,000 pension plan beneficiaries.

Maxar was of Colorado-based DigitalGlobe Inc. and the Richmond aerospace firm originally known as MacDonald, Dettwiler and Associates Ltd. (MDA). The Canadian company was best known for developing the ÎÚÑ»´«Ã½rm robotic instrument used on space shuttles.

The goal of the merger was to give MDA greater access to lucrative American defence contracts by reincorporating as a U.S. company with American leadership.

Within three years unit to a Toronto-based consortium led by Northern Private Capital.

MDA Ltd. (TSX:MDA) is now headquartered in Brampton, Ont.

Advent has agreed to buy all of Maxar’s common stock for US$53 a share – a premium of 129 per cent over the company’s closing stock price of US$23.10 Thursday on the New York Stock Exchange.

Maxar’s shares were trading as low as US$5 in the years that followed the MDA and DigitalGlobe merger after initially trading as high as US$65.

The deal has yet to close and Maxar’s board has 60 days to solicit acquisitions from other potential buyers. If a buyer comes around with a better deal, the board will have the right to end the deal with Advent.

If no alternative buyers emerge, the deal is expected to close in mid-2023, pending regulator and shareholder approval.

Maxar said expects to continue using the same brand and remain headquartered in Colorado if the deal goes through.

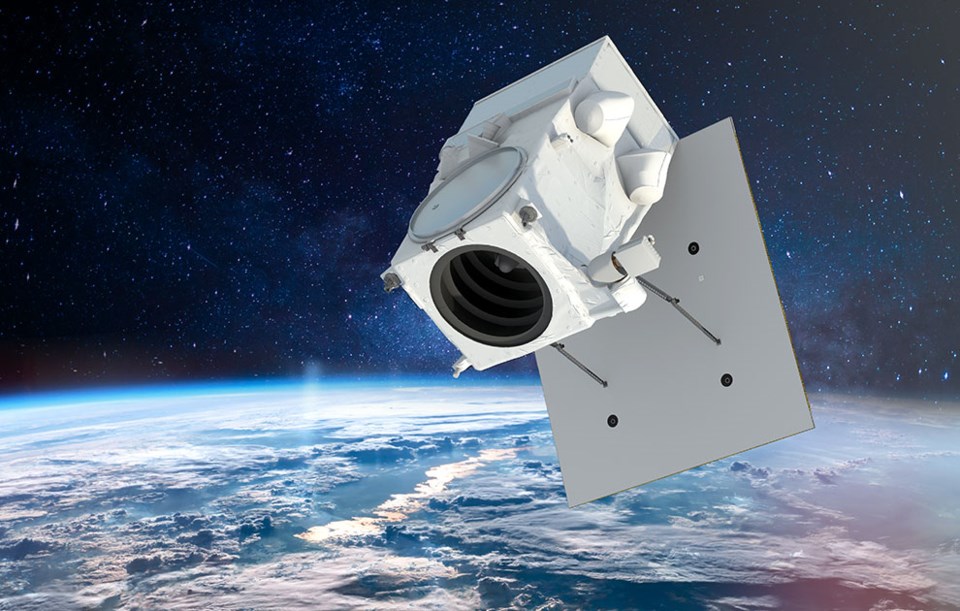

“In our view, Maxar is a uniquely positioned and attractive asset in satellite manufacturing and space-based high-resolution imagery, with an incredible workforce and many opportunities ahead,” Shonnel Malani, managing director of Advent’s aerospace and defence team, said in a statement.

“Our goal is to invest in expanding Maxar’s satellite constellation as well as supporting Maxar’s team to push the boundaries of innovation, ensuring mission success for its customers.”